-

-

-

Elections

-

Issues

-

-

-

-

-

-

-

ISSUES

SVTA Joins Coalition:

Californians to Stop Higher Property Taxes

California Legislators consider gutting Prop. 13

April 9, 2013

Finally! School bonds are coming under fire in the press,

for their exorbitant cost and mismanagement--

jibing with what SVTA has been saying for years!

First, read about the problem, here:

The Daily Journal (San Mateo County) - April 19, 2014

Mark Hinkle, SVTA President quoted in article about the Sequoia High School $265M bond measure:

Sequoia bond measure seeks to address overcrowding issue: Opposition to June ballot item says district is spending irresponsibly

Then, learn how easy it is for you to represent taxpayers on a

citizens' bond oversight committee!

California taxpayers threatened with easing of tax measure threshold,

and San Jose City Council backs this deleterious development.

A majority of San Jose City Council (9:2) voted on March 5, 2013 to support California state legislature's move to decimate taxpayers' rights by dropping the 2/3 passage requirement for tax-hike measure to a mere 55% majority.

SVTA would like to thank Councilmembers Constant and Khamis for their votes against this move, showing their support of the taxpayers of San Jose.

Background:

SVTA board member Aaron Neighbour was interviewed by SJ Mercury News

after opposing the move at SJ City Council.

Councilmember Khamis issued this recommendation.

Protect Small Businesses and Consumers' Choice!

SVTA is a member of the We R Here* coalition,

opposing the (so-called) Marketplace Fairness Act

Note, too, that Americans for Tax Reform is fighting this tax legislation.

* We Enabled Retailers Helping Expand Retail Employment

SVTA Joins Coalition:

Californians to Stop Higher Property Taxes

California Legislators consider gutting Prop. 13

Recent reports indicate a renewed interest by the spending lobby in increasing property taxes on non-homeowners. This aggressive tax increase would have a devastating impact on California’s economy.

A split roll property tax will increase property taxes on businesses by an estimated $6 billion, according to a recent Pepperdine Study.

Increased property taxes damage small business property owners and tenants alike. Because small businesses typically lease properties where the cost of property taxes is passed through to the tenant, employment losses would be disproportionately concentrated in small businesses, and especially those owned by women and minorities.

April 9, 2013

Finally! School bonds are coming under fire in the press,

for their exorbitant cost and mismanagement--

jibing with what SVTA has been saying for years!

First, read about the problem, here:

The Daily Journal (San Mateo County) - April 19, 2014

Mark Hinkle, SVTA President quoted in article about the Sequoia High School $265M bond measure:

Sequoia bond measure seeks to address overcrowding issue: Opposition to June ballot item says district is spending irresponsibly

San Jose Mercury News - March 8, 2013

Santa Clara and San Mateo County school districts use costly bonds

Editorial

and here:Santa Clara and San Mateo County school districts use costly bonds

Editorial

Mountain View Voice - March 8, 2013

Trustees question Measure G management by Nick Veronin

citizens' bond oversight committee!

Attend our coaching on Saturday, March 16, for how to apply to your local school bond or parcel tax oversight committee, and what to do once you're appointed.

Phone 408-279-5000 408-279-5000 or e-mail info@SVTaxpayers.org. Ask for Bill Becker, chairman of SVTA's Bond Oversight committee.

408-279-5000 or e-mail info@SVTaxpayers.org. Ask for Bill Becker, chairman of SVTA's Bond Oversight committee.

Phone 408-279-5000

California taxpayers threatened with easing of tax measure threshold,

and San Jose City Council backs this deleterious development.

A majority of San Jose City Council (9:2) voted on March 5, 2013 to support California state legislature's move to decimate taxpayers' rights by dropping the 2/3 passage requirement for tax-hike measure to a mere 55% majority.

SVTA would like to thank Councilmembers Constant and Khamis for their votes against this move, showing their support of the taxpayers of San Jose.

Background:

SVTA board member Aaron Neighbour was interviewed by SJ Mercury News

after opposing the move at SJ City Council.

Councilmember Khamis issued this recommendation.

Protect Small Businesses and Consumers' Choice!

SVTA is a member of the We R Here* coalition,

opposing the (so-called) Marketplace Fairness Act

On-line commerce has revolutionized small business by allowing a bricks-and-mortar store anywhere to operate everywhere. Consumers across America are benefiting from having more product choices, greater availability, and competitive pricing. Small on-line retail businesses in thousands of U.S. communities are growing and creating jobs in their hometowns.

But current proposed Internet sales tax legislation threatens to kill the growth and job creation potential of small on-line retailers.

This legislation would compel retailers to calculate, collect, and turn over sales taxes from and to every geographical jurisdiction (city, county, state) in which their on-line customers reside.

All in the name of "fairness"--just like the IRS!

Learn more about this issue here.

Note, too, that Americans for Tax Reform is fighting this tax legislation.

* We Enabled Retailers Helping Expand Retail Employment

SVTA is member of the STOP SPECIAL INTEREST MONEY NOW coalition

Stop Special Interest Money Now (SSIM) will appear as an initiative on the November, 2012 general election ballot. It will fundamentally change Sacramento by quieting the noise made by big money corporations and big money unions so that voters can be heard once again by their elected representatives. It will:

1) ban both corporate and labor union contributions to state and local candidates.

2) prohibit government contractors from contributing to state and local officials who can award them contracts.

Read the full text of the measure here. Visit the official campaign site at: www.StopSpecialInterests.org.

Association Mourns Loss of President Doug McNea

By Bill Becker

SVTA Treasurer and Member of the Board of Directors

The news that our president, friend, and colleague Doug McNea passed away suddenly while attending the California Republican Convention in Sacramento on March 19, 2011 came as a profound shock. Doug’s death leaves a huge void in our organization at a time when taxpayers throughout Silicon Valley are facing unprecedented challenges.

It was my privilege to serve with Doug on the SVTA board for a number of years. Doug was an eloquent and dedicated champion of taxpayer interests and a tireless advocate for the principles of limited government, fair taxation, protection of property rights, and transparency in all public affairs. I know that all members of the SVTA join me in expressing condolences to Doug’s family at this time of their great loss.

Member Survey will guide 2011 priorities

In the next few weeks, a random sample of SVTA members will be asked to participate in a survey that will help set our priorities for 2011. The survey will also provide members an opportunity to volunteer to participate directly in the work of the Association. Regardless of whether you are selected to receive the survey, we welcome your comments and suggestions regarding the work of the SVTA and issues that we should address.

If you have ever attended a meeting of a city council, the Board of Supervisors, or any other public body, you have no doubt noticed that special interests – especially those calling for expanded government programs and a larger share of your hard-earned dollars – are always well represented. This is especially true of the public employee unions that also play a huge role in electing the same officials from whom they seek higher pay and benefits. All too often, the taxpayers are vastly outnumbered – if they are represented at all.

We need your active involvement to make our voices heard. The process begins with the membership survey, so we hope you will respond when you are contacted.

Special Note: Please send us your e-mail address!

We currently have e-mail addresses for only about 10 percent of SVTA members. In these days of fast-moving events (and limited resources), we often have an urgent need to communicate with SVTA members. By providing us with your email address, we can provide the latest information about threats to taxpayers and notification of opportunities to make our voices heard.

We will not share your email address with any other organization (although we may occasionally forward share information provided to us by other taxpayer groups).

Please provide your email contact information to: info@svtaxpayers.net

Is the real problem that taxes aren’t high enough?

To listen to many public officials, you’d think the real cause of the incredible budget deficits that the State of California and many local communities are facing is that citizens aren’t paying enough taxes – in effect, that you get to keep too much of the money you earn.

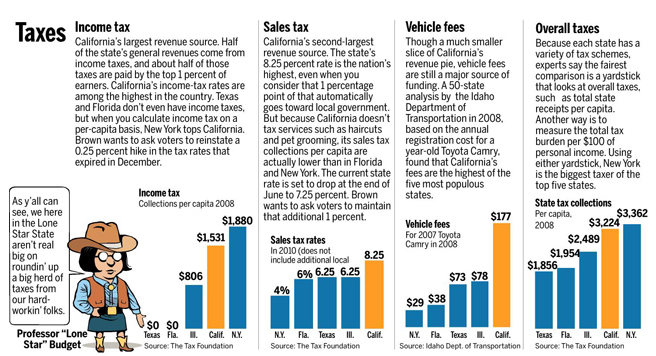

How does this perception compare to reality? The San Jose Mercury News recently ran an article comparing California’s tax burden to those of other large states. The article included the following table:

Clearly, the problem is not that we aren’t taxed enough – but that government spends too much!

Californians hit hard by economic recession

Data released by the Franchise Tax Board reveal just how hard the prolonged economic recession has hit California residents. The median income on individual returns filed in 2009 was $34,079, down 5.1 percent from 2008. The median income reported by taxpayers filing joint returns was $65,025, down 5.7 percent from a year earlier.

Despite the sharp decline in earnings by Californians, state and local governments continue to spend more and demand an ever-greater share of your money.

VICTORY! Open-Space Tax Ruled Illegal

On July 14, 2008, SVTA won its lawsuit against Santa Clara County's Open Space Authority and that agency's 2001 illegal "special assessment" on property owners. The California Supreme Court ruled unanimously and supported all of our points. This ruling is a boon for all California taxpayers, who would likely have been subject to similar unconstitutional taxes in their local jurisdictions, had we lost the case.

Click here for the press release (PDF format) from the law offices of our attorney, Tony Tanke.

Click here for the court's decision (MS Word format).

Click here for a statement (MS Word format) from Howard Jarvis Taxpayers Association, a major co-plaintiff in the case.

Click here for the article posted on line by the San Jose Mercury News on July 14, 2008 (also posted on our "Issues" page).